This (Rate) part of any tax liability is most searched and asked over the period of time so that people can plan accordingly. So friends, today we are going to know about rate(s) of GST in India.

When GST Council announced rates after the 14th meeting held at Srinagar, Jammu & Kashmir on May 18, 2017, a curiosity massively hit across industry and trade associations. Every single person or an entity etc. was evaluating its impact on them.

There are 98 Chapters explaining products/services.

But in this post, we will not discuss the overall impact. We will just touch the rate(s) part only.

GST Slab

We have the following rates under GST regime:

• 0% or NIL

• 5%

• 12%

• 18%

• 28%

Let’s see what items or products and services are under these rates

Under 0% or Nil:

• Milk

• Curd

• Unpacked Foodgrains

• Unpacked Panner

• Besan

• Eggs

• Salt

• Health Services

• Educational Services

• Unbranded Atta

• Unbranded Maida

• Phool Jhadoo

Under 5%:

• Milk Food for babies

• Skimmed Milk Powder

• Spices

• Tea

• Fabric

• Footwear (<500)

• Apparels (<1000)

• Packed Paneer

• Domestic LPG

• Cashew Nuts

• Life-Saving Drugs

• Coir Mats, Matting & Floor Covering

Under 12%:

• Almonds

• Fruit Juice

• Ghee

• Butter

• Processed Food

• Packed Coconut Water

• Jam

• Jelly

• Pickle

• Murabba

• Mobiles

• Computers

Under 18%:

• Ice Cream

• Soups

• Corn Flakes

• Hair Oil

• Soaps

• Toothpaste

• Printers

• Industrial Intermediaries

• Toiletries

• CCTV

• Aluminium Foils

• Pasta

Note: Professional Services are also under 18% (CA/CS etc.)

Under 28%:

• Waffles and wafers coated with chocolate or containing chocolates

• Beauty Products

• Air Conditioners

• Fridge

• Washing Machines

• Pan Masala

• Other non-alcoholic beverages

• Paints and Varnishes (removers as well)

• Cigarettes and aerated drinks (+15% Cess extra)

• Small Cars (with 1% or 3% Cess extra)

• High-end Motor Bikes (+15% Cess extra)

• Luxury Cars Like BMW, AUDI (+15% Cess Extra)

Plus, it was announced that:

• for restaurants serving alcohol, the tax bracket will be 18%

• services on Non-AC restaurants will be 12%

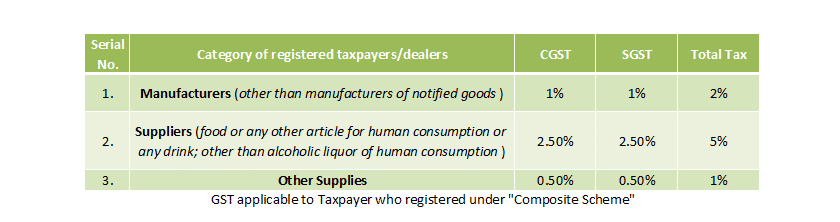

GST rates for Composite Scheme:

Above mentioned products/services are just excerpts from the approved GST rates. There are many items, products, and services lying under different rates of GST. Soon I will provide the complete downloadable book for your ready reference.

Disclaimer: All rates & codes are best to our latest information. However, there may be variations due to Government’s latest updates. We are not responsible for any wrong information.

That’s it for this post. I hope you gained some insights from this post.

In the upcoming posts you will know about:

• Supply Chain and GST

• GST – International Scenario (as we have global readers)

• GST Model & Registration

and

• The special one “GST – E-Commerce and Digital Business

I will try to present it into pieces so that a normal person can absorb the information easily. I know this taxation part is so boring but very essential part of a business.

Please comment below regarding your doubts and questions about GST. Also, let me know what do you want to learn or expect from me?

Don’t lose your focus, stay connected and learn Entrepreneurship.

At the end I would again like to encourage you with another quote of mine:

“Entrepreneurship is a minset,

it automatically creates the legacy.” -Rajiv

Thanks for your valuable time, talk to you more about GST in next post.

#flyhigh & #LiveYourPassion

A visionary, catalyst, educator, corporate strategist, successful serial entrepreneur, founder of many ventures including a Public Limited Company “Catalystic® Digiprenuer Enterprises Limited”, initiator of Arthkaar®, various socio-economic projects, and very passionate about new business opportunities; encouraging and equipping young entrepreneurs with different private and Government platforms, and a dynamic visiting faculty with the Ministry of MSME_Govt. of India and active national member with World Human Rights Protection Council to advocate Human Rights.