In this post, you will know about various factors associated with Indian GST. It will help you to understand it better.

Structure:

On July 01, 2017 India has implemented ‘dual GST’. In ‘dual GST’ regime, all the transactions of goods and services made for a consideration would attract two levies i.e. CGST (Central GST) and SGST (State GST).

Taxes which are subsumed in GST:

GST is now levied on all the transactions of goods and services made for a consideration. This new levy had replaced almost all of the indirect taxes. In particular, it had replaced the following indirect taxes:

At Central level

• Central Excise Duty (including Additional Duties of Excise)

• Service Tax

• CVD (levied on imports in lieu of Excise duty)

• SACD (levied on imports in lieu of VAT)

• Central Sales Tax

• Excise Duty levied on Medicinal and Toiletries preparations,

• Surcharges and cesses

At State level

• VAT/Sales tax

• Entertainment tax (unless it is levied by the local bodies)

• Luxury Tax

• Taxes on lottery, betting, and gambling

• Entry tax not in lieu of Octroi

• Cesses and Surcharges

However, certain items/sectors are outside the GST regime. Products such as alcohol, petroleum products remain outside GST regime. Further, Land and properties also are remained outside since they are neither goods nor services.

Looking at the international practices on GST, it is advisable that the products outside GST regime should be minimum as allowing parallel levies will only add to cascading effect than any good to industry/economy.

Administration:

CGST and IGST are under the administration of ‘Central Government’ and SGST is under the administration of the respective State Governments.

Law relating to GST:

In GST regime, there is one CGST law and 31 SGST law for each of the States including two Union Territories and one IGST law governing inter-State supplies of goods and services.

Mechanism of input tax credit in GST:

Input tax credit of CGST would be available for payment of CGST and input tax credit of SGST would be available for payment of SGST.

However, cross utilization of tax credit between the Central GST and the State GST would be allowed in the case of inter-State supply of goods and services under the IGST model.

Interstate transactions in GST:

All the inter-State transactions of goods and services would attract IGST (which would be CGST plus SGST). The inter-State seller will pay IGST on value addition after adjusting available credit of IGST, CGST, and SGST on his purchases.

The Exporting State will transfer to the Centre the credit of SGST used in payment of IGST. The Importing dealer will claim a credit of IGST while discharging his output tax liability in his own State. The Centre will transfer to the importing State the credit of IGST used in payment of SGST.

Composition scheme:

Goods and Services Tax is set to bring along a new regime of business compliance in India. Large organizations have the requisite resources and expertise to address these requirements. On the flip side, many startups and Small and Medium Enterprises (SMEs) may struggle to comply with these provisions. To resolve such scenarios, the government has introduced Composition Scheme under GST, which is merely an extension o the current scheme under VAT law.

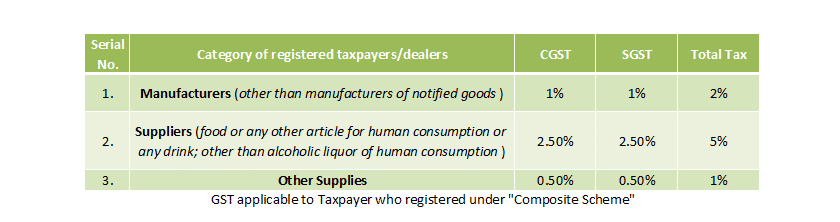

There is an option available to tax payers having the turnover less than Rs. 75 lacs can opt for Composition scheme wherein they need to discharge tax at a floor rate mentioned below in the picture:

Exports and SEZ:

Exports are zero rated, as previously, they were. In the case of SEZ, if the supply of goods or services is for consumption in processing zone then it would be zero rated by refund mechanism.

Imports:

Even under GST regime, Customs duty would be levied on import of goods in India.

Previously, import of ‘goods’ suffers CVD (in lieu of Excise duty) and SACD (in lieu of VAT). On import of taxable services, Service tax is attracted.

In GST regime, both CGST and SGST would be levied on import of goods and services.

Special Area Schemes*:

The exemptions available under Special Industrial Area Schemes would continue up to legitimate expiry time both for the Centre and the States. After the introduction of GST, the tax exemptions, remissions etc. related to industrial incentives would be converted, if at all needed, into cash refund schemes.

That’s it for this post as GST is a broad topic. So it is beneficial to consume the information in chunks. It will save you to get overwhelmed. I hope you gained some insights from this post.

In the upcoming posts you will know about:

• Ten Things You must know as an entrepreneur about GST

• Rate of GST

• Supply Chain and GST

• GST – International Scenario (as we have global readers)

• GST Model & Registration

and

• The special one “GST – E-Commerce and Digital Business

I will try to present it into pieces so that a normal person can absorb the information easily. I know this taxation part is so boring but very essential part of a business.

Please comment below about your doubts and questions about GST. Also, let me know what do you want to learn or expect from me?

Don’t lose your focus, stay connected and learn Entrepreneurship.

Thanks for your valuable time, talk to you more about GST in next post.

#flyhigh & #LiveYourPassion

Courtesy: A special thanks to our beloved CA Pritam Mahure for his guidance and efforts.

A visionary, catalyst, educator, corporate strategist, successful serial entrepreneur, founder of many ventures including a Public Limited Company “Catalystic® Digiprenuer Enterprises Limited”, initiator of Arthkaar®, various socio-economic projects, and very passionate about new business opportunities; encouraging and equipping young entrepreneurs with different private and Government platforms, and a dynamic visiting faculty with the Ministry of MSME_Govt. of India and active national member with World Human Rights Protection Council to advocate Human Rights.